Building BlackOrigin: A Scalable Trading Bot for SaaS Marketplaces

We built BlackOrigin, a SaaS trading automation platform designed to execute lightning-fast trades on Bybit, powered by real-time TradingView signals.

The mission was simple yet demanding:

“Execute buy and sell orders instantly, size positions optimally, and compare cross-market prices — all while ensuring safety, reliability, and low latency.”

This post walks you through the architecture, technology choices (especially RabbitMQ), implementation highlights, hard lessons learned, and the results achieved.

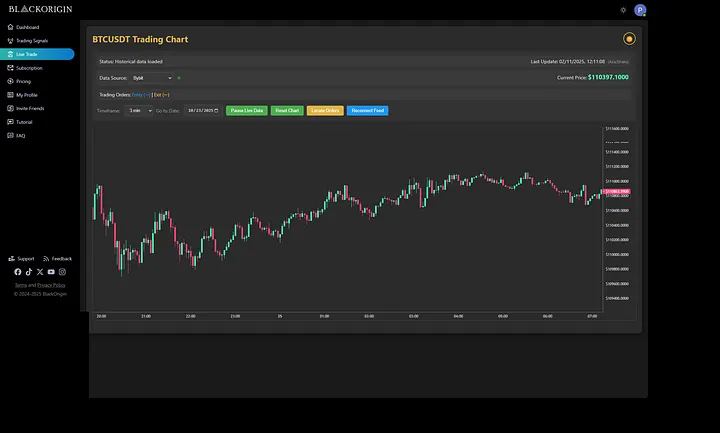

🧭 Project Overview

BlackOrigin is a scalable SaaS trading application built for high-volume, real-time automated trading.

It listens to TradingView signals, computes trade quantities and risks, executes orders on Bybit, and continuously compares prices across multiple exchanges to optimize trading outcomes.

Core Capabilities

⚡ Real-Time Signal Processing: Instantly reacts to TradingView alerts.

🔁 Automated Trade Lifecycle: Signal reception → position sizing → execution → confirmation → monitoring.

🌐 Cross-Market Price Comparison: Checks multiple exchanges for optimal trade execution.

🔒 Concurrency Safety: Redis-based distributed locks prevent overlapping trades.

🧠 Resilience & Observability: Prometheus, Grafana, and Loki ensure transparent monitoring and error recovery.

📢 User Notifications: Telegram, email, and browser alerts (via OneSignal).

🚨 Error Alerts: Slack notifications instantly notify admins and superadmins of system errors.

🧩 Technology Stack

| Layer | Technology | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Backend | Laravel (PHP) |

|||||||||||||

Frontend | Next.js |

|||||||||||||

Message Broker / Queue | RabbitMQ (high-throughput async processing) |

|||||||||||||

Caching & Locks | Redis |

|||||||||||||

Database | MySQL |

|||||||||||||

WebSocket | Laravel Reverb & Pusher |

|||||||||||||

Monitoring | Prometheus, Grafana, Loki, Promtail |

|||||||||||||

Payment Gateways | Stripe, Zip, Klarna, AfterPay, Volet (Crypto) |

|||||||||||||

APIs | REST, SOAP |

|||||||||||||

Authentication | JWT-based |

|||||||||||||

Third-Party Logins | Google, Telegram, Apple, Twitter, Facebook |

|||||||||||||

Notifications | Telegram, Email, Browser (OneSignal), Slack |

TradingView signals arrive fast — sometimes sending exit signals before entry trades are fully executed or when an entry signal fails.

To maintain consistent, safe trading logic, order dependencies must be preserved.

Rule: “An exit signal must never execute unless the corresponding entry trade succeeded.”

The Real Problem

- TradingView sends ENTRY → system enqueues entry job.

- Entry job fails (timeout/API error).

- The exit signal arrives soon after.

- Without correlation, the bot tries to close a trade that never opened → false or damaging orders.

Limitations of Laravel’s Default Queue

- ❌ No built-in message correlation (entry ↔ exit).

- ❌ No dead-letter exchanges (DLX) for structured retries.

- ❌ No conditional routing or delayed requeue logic.

- ❌ No management UI for inspecting or replaying messages.

- ❌ Manual DB checks needed — inefficient and error-prone.

Why RabbitMQ Wins

✔ Native support for dependency-based routing

✔ Built-in delayed retries and DLX

✔ Strong message ordering and visibility

✔ Full control via management UI

✔ Scales horizontally for live trading systems

⚙️ Architecture & Workflow (High-Level)

- TradingView sends a signal via webhook or REST endpoint.

- The backend normalizes the signal and enqueues it in RabbitMQ.

- Worker consumers calculate trade size and place orders on Bybit.

- Redis distributed locks ensure no conflicting trades occur for the same symbol.

- Prometheus, Grafana, and Loki handle monitoring and logs.

- Notifications are pushed to users and admins in real time.

🚀 Implementation Highlights

1. Concurrency Safety

Redis distributed locks serialize operations to prevent race conditions (e.g., two simultaneous signals for the same pair).

2. Retry & Idempotency

Each job uses unique idempotency keys, ensuring retries never cause duplicate executions.

3. Queue Specialization

RabbitMQ queues are separated by task type and priority — entry, exit, and settlement — ensuring ordered and controlled message flow.

4. Data Aggregator

A dedicated microservice normalizes price feeds from multiple exchanges, merging them into a canonical market feed for real-time price comparison.

5. Real-Time Frontend

Next.js frontend receives live WebSocket updates on trade status and price changes for a seamless dashboard experience.

🧠 Challenges & Lessons Learned

1. Payment Integration Complexity

Integrating multiple gateways (Stripe, AfterPay, Zip, Klarna, Volet) required handling different currencies, payment flows, and asynchronous webhooks.

Solution:

- Added multi-currency validation layers.

- Implemented conversion and reconciliation logic.

- Enhanced webhook retry and logging systems.

2. Queue Ordering & Concurrency

Ensuring entry-before-exit message flow in concurrent systems was critical.

Solutions:

- Created priority queues and routing keys for order-sensitive jobs.

- Used Redis locks and idempotency keys to enforce sequencing and avoid duplication.

3. Real-Time Multi-Exchange Synchronization

Different exchange APIs had varying latencies and formats, complicating trade reconciliation.

Solutions:

- Built a data aggregator to normalize and timestamp feeds.

- Optimized WebSocket multiplexing to reduce latency.

- Designed a lightweight reconciliation loop to match trade executions with market snapshots using tolerance windows.

📊 Results & Impact

✔ Low-Latency Execution: Trades executed in real time, even under heavy signal loads.

✔ Reliable Payment Support: Seamless integration of fiat and crypto gateways with secure webhook recovery.

✔ Scalable Architecture: RabbitMQ + Redis + Worker clusters enabled horizontal scalability.

✔ Robust Operations: Retry, idempotency, and distributed locks reduced trade conflicts drastically.

✔ Maintainable Foundation: Modular architecture supports future expansion to new exchanges, markets, and strategies.

Building BlackOrigin wasn’t just about coding a trading bot — it was about designing a scalable, fault-tolerant, and observant SaaS architecture capable of handling real-world trading chaos.

By leveraging RabbitMQ, Redis, and observability stacks, BlackOrigin achieved speed, stability, and transparency — three pillars essential for any automated trading platform.

_1760528543.webp)